Regulatory Agencies Such As The Occ And The Fdic Add To The Banking System

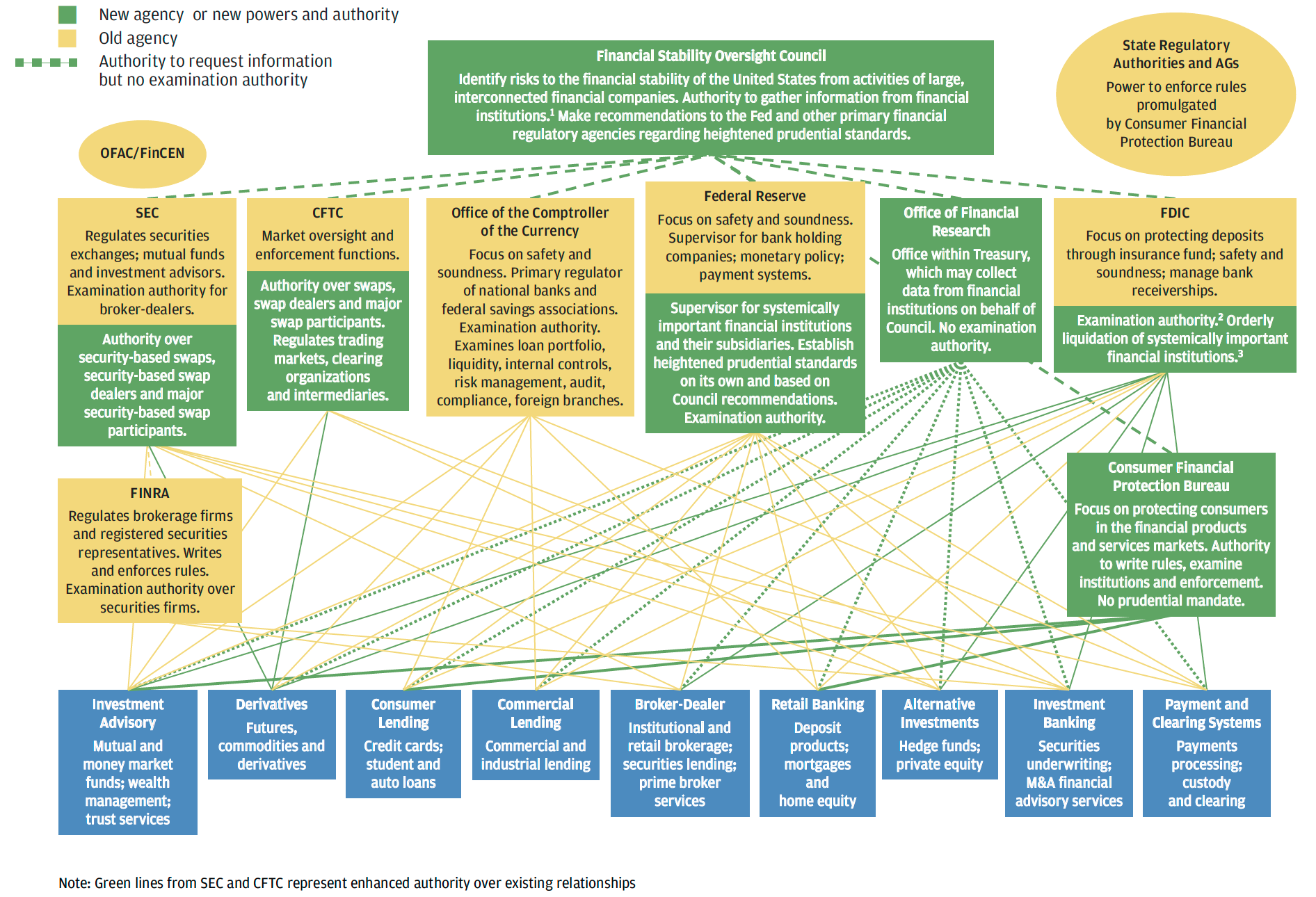

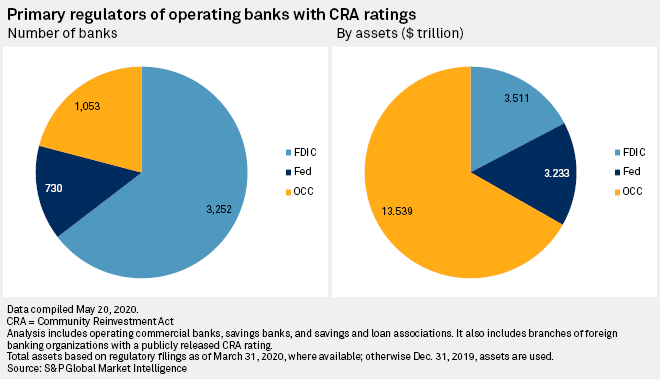

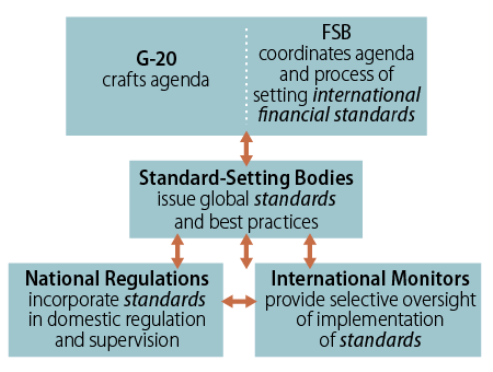

Regulatory agencies such as the occ and the fdic add to the banking system. Such do-mestically operating banks are called state member banks The Federal Reserve shares supervisory and regulatory responsibility for domestic banks with the OCC and the FDIC at the federal level and with individual state banking departments at the state level. The safety of the banking system could be mainly attributed to the contributions made by regulatory agencies such as the OCC and the FDIC. The FDIC stands for Federal Deposit Insurance Corporation which exists to provide consumers with deposit insurance.

The Fed and the FDIC the Fed and OSHA the FDIC and the EPA. Regulatory agencies such as the OCC and the FDIC add risklawsmonopoliessafety to the banking system. The safety of the banking system could be mainly attributed to the contributions made by regulatory agencies such as the OCC and the FDIC.

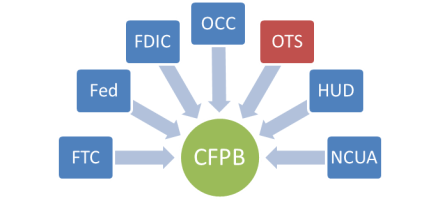

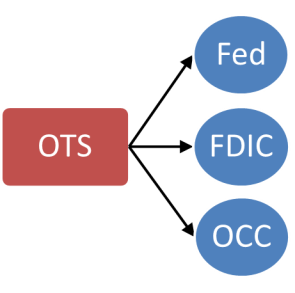

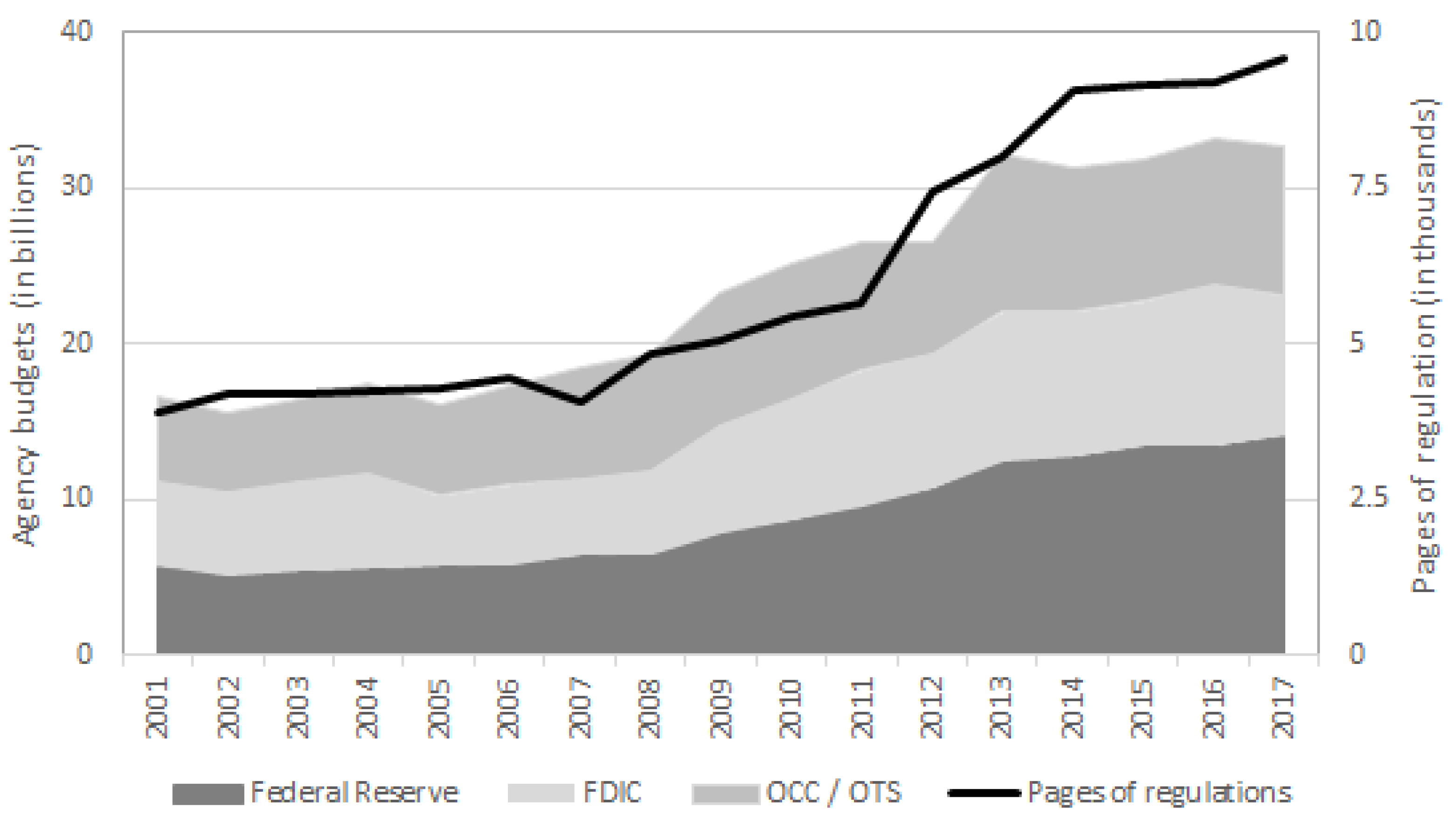

FFIEC includes five banking regulatorsthe Federal Reserve Board of Governors FRB the Federal Deposit Insurance Corporation FDIC the National Credit Union Administration NCUA the Office of the Comptroller of the Currency OCC and the Consumer Financial Protection Bureau CFPB. These investments caused many citizens to lose their money during the Great Depression. Two federal agencies share responsibility for state banks.

B generally lend out a majority of the funds deposited. 2 question Regulatory agencies such as the occ and the fdic add to the banking system. Asked Oct 23 in Other by megha00 Expert 349k points Under a fractional-reserve banking system banks.

The Office of the Comptroller of the Currency is an independent bureau within the United States Department of the Treasury that was established by the National Currency Act of 1863 and serves to charter regulate and supervise all national banks and thrift institutions and the federally licensed branches. The Fed and the FDIC. Economic Unit 4 review 122 Terms.

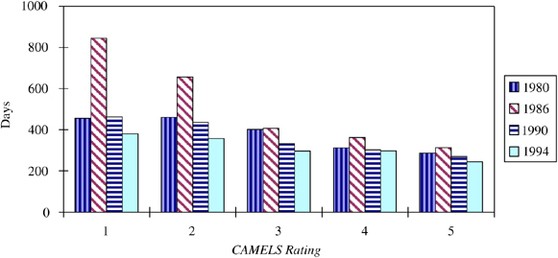

The FDIC also insures deposits in banks and federal savings associations in the event of bank failure. To protect consumers the SEC requires brokers and dealers to ______________. The Banking Act of 1933 was a reaction to the Great Depression because it worked to protect deposits from risky investments by banks.

Federal Deposit Insurance Corporation FDIC - The FDIC insures state-chartered banks that are not members of the Federal Reserve System. Sun Mar 11 2018 The Federal Reserve System.

Protections occurred through the creation of regulations and new agencies to oversee financial institutions.

The Fed and the FDIC. Regulatory agencies such as the OCC and the FDIC add risklawsmonopoliessafety to the banking system. The Office of the Comptroller of the Currency is an independent bureau within the United States Department of the Treasury that was established by the National Currency Act of 1863 and serves to charter regulate and supervise all national banks and thrift institutions and the federally licensed branches. Regulatory agencies such as the OCC and the FDIC add _____ to the banking system. Such do-mestically operating banks are called state member banks The Federal Reserve shares supervisory and regulatory responsibility for domestic banks with the OCC and the FDIC at the federal level and with individual state banking departments at the state level. Two federal agencies share responsibility for state banks. A goal of financial regulatory agencies is to. The Banking Act of 1933 was a reaction to the Great Depression because it worked to protect deposits from risky investments by banks. Sun Mar 11 2018 The Federal Reserve System.

Banks that have chosen to join the Federal Reserve System. Sun Mar 11 2018 The Federal Reserve System. Regulatory agencies such as the OCC and the FDIC add _____ to the banking system. The FDIC stands for Federal Deposit Insurance Corporation which exists to provide consumers with deposit insurance. Regulatory agencies such as the OCC and the FDIC add _____ to the banking system. Such do-mestically operating banks are called state member banks The Federal Reserve shares supervisory and regulatory responsibility for domestic banks with the OCC and the FDIC at the federal level and with individual state banking departments at the state level. Econ- Unit 5 45 Terms.

Post a Comment for "Regulatory Agencies Such As The Occ And The Fdic Add To The Banking System"